Here are a few examples:

- We have established more than 300 TIF Districts and numerous Business Development Districts throughout Illinois and annually administer hundreds of intergovernmental agreements and private redevelopment agreements for more than 90 Illinois municipalities.

- During 2022, we directed the statutory use and annual reporting for more than $64 million of TIF real estate tax increment generated by our client communities.

- Our TIF Redevelopment Plans have attracted more than $2.5 billion of new private investment and more than 4,000 new jobs since 1986.

- Increased stability for local population and school enrollments is often a significant objective for communities where new TIF residential projects are undertaken.

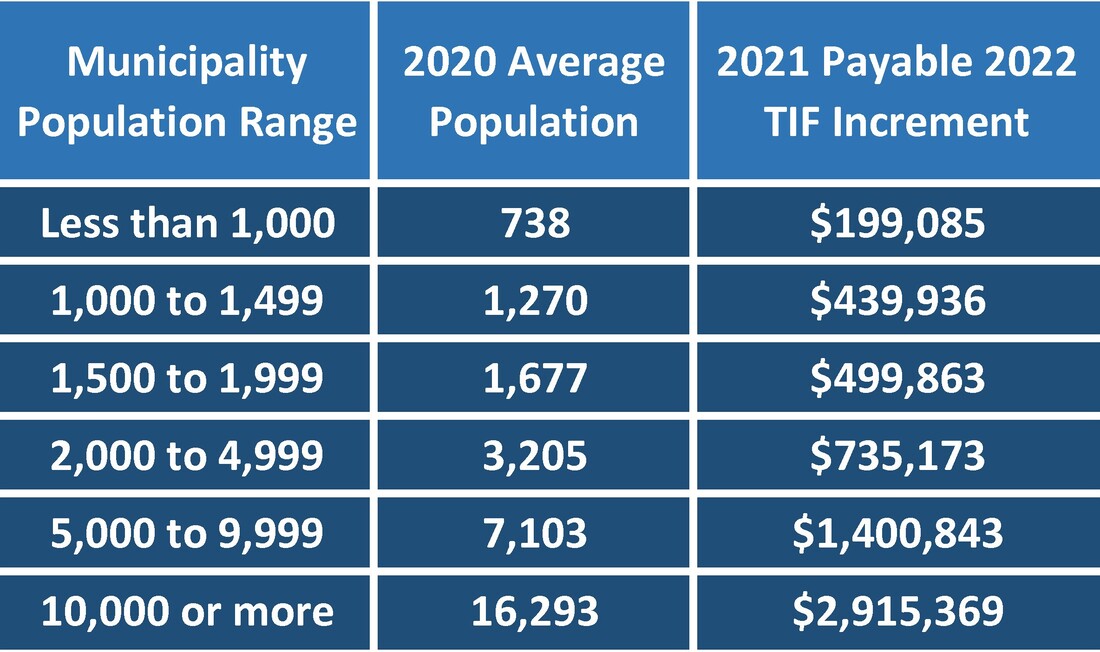

- Remarkable increases in municipal revenues have occurred as a result of the Tax Increment Financing Districts we have established. For tax year 2021, the overall annual average real estate tax increment generated by our client municipalities was $837,098 (see chart above for breakdown by population group).

We are a Single Source for Legal Advice and Economic Development Consulting

Our unique business model, TIF IllinoisSM, brings together two firms with expertise in public and private partnerships specializing in the use of Tax Increment Financing and other business incentive tools to:

Our Clients Report High Value

Our unique business model, TIF IllinoisSM, brings together two firms with expertise in public and private partnerships specializing in the use of Tax Increment Financing and other business incentive tools to:

- Stimulate economic development, particularly in smaller, rural communities located outside of the Chicago and Cook County metro area

- Generate new sources of revenue and enhance community vitality through creative growth solutions

- Relieve local staff of annual administrative, reporting and compliance burdens

Our Clients Report High Value

- Coordinated legal support and ongoing consulting and administrative services that provide your city simplicity in creating and managing TIF Districts and other economic development tools as permitted by Illinois law.

- An annual flat-fee approach and easy to understand billings to keep your development expenses manageable, predictable and easy to understand.

- Innovative economic development “problem solving” that generates unique solutions and new opportunities in ways you may not have previously considered.

- Responsiveness and consistent quality, allowing you to focus on results rather than the details of the process or complicated statutory requirements.

- Contact us to arrange a no-obligation consultation to explore how our services may be applicable to your community's needs.

We Engage, Support, Sponsor and Collaborate with Numerous Statewide Organizations

- Council of Development Finance Agencies (CDFA)

- Federal Reserve Bank of Chicago

- Illinois Department of Commerce & Economic Opportunity

- Illinois Economic Development Association (IEDA)

- Illinois Institute for Rural Affairs (IIRA)

- Illinois Municipal League

- Illinois Rural Partners

- Illinois State Bar Association

- Illinois State Chamber of Commerce

- Illinois Tax Increment Association (ITIA)

- Midwest Community Development Institute (Midwest CDI)

- Stevenson Center for Community and Economic Development

- University of Illinois Community and Economic Development