Tax Increment Financing (TIF) is a means by which cities, towns, and villages may achieve a level of community and economic development far beyond current expectations. TIF is particularly useful to communities where local leaders envision a resurgence of population, a robust local economy, and a town capable of providing the varied public services, security, and quality of life so many young families, workers, business owners, and elderly persons are searching for today.

.A TIF District's revenues ("tax increment") come from the increased assessed value of property and improvements that occur within the District. Once a TIF District is established, the "base" assessed value is determined. As vacant land and dilapidated properties develop with TIF assistance, the equalized assessed valuation (EAV) of those properties increases. New property taxes resulting from the increased assessed valuation above the base value create an incremental increase in tax revenues generated within the TIF District.

The "tax increment" created between the "base" and the new EAV is captured, deposited into a special city TIF account and used solely for economic development. The real estate tax increment can be used as a source of revenue to reimburse certain costs for public and private redevelopment projects either by issuing TIF Revenue Bonds or by reimbursing developers on a "pay-as-you-go" basis. All of the other overlapping taxing bodies continue to receive real estate tax revenue from the base assessed valuation, so there is no loss of revenue to those local taxing bodies.

The maximum life of a TIF District is 23 years. When the TIF ends and the town's investments in both public and private redevelopment projects within the TIF redevelopment area are fully repaid, property tax revenues are again shared by all the taxing bodies. All taxing bodies then share the expanded tax base – the growth which would not have been possible without the utilization of Tax Increment Financing. The majority of TIF Districts in Illinois are established and annually administered pursuant to the Tax Increment Allocation Redevelopment Act (65 ILCS 5/11-74.4 et. seq.).

.A TIF District's revenues ("tax increment") come from the increased assessed value of property and improvements that occur within the District. Once a TIF District is established, the "base" assessed value is determined. As vacant land and dilapidated properties develop with TIF assistance, the equalized assessed valuation (EAV) of those properties increases. New property taxes resulting from the increased assessed valuation above the base value create an incremental increase in tax revenues generated within the TIF District.

The "tax increment" created between the "base" and the new EAV is captured, deposited into a special city TIF account and used solely for economic development. The real estate tax increment can be used as a source of revenue to reimburse certain costs for public and private redevelopment projects either by issuing TIF Revenue Bonds or by reimbursing developers on a "pay-as-you-go" basis. All of the other overlapping taxing bodies continue to receive real estate tax revenue from the base assessed valuation, so there is no loss of revenue to those local taxing bodies.

The maximum life of a TIF District is 23 years. When the TIF ends and the town's investments in both public and private redevelopment projects within the TIF redevelopment area are fully repaid, property tax revenues are again shared by all the taxing bodies. All taxing bodies then share the expanded tax base – the growth which would not have been possible without the utilization of Tax Increment Financing. The majority of TIF Districts in Illinois are established and annually administered pursuant to the Tax Increment Allocation Redevelopment Act (65 ILCS 5/11-74.4 et. seq.).

A TIF District's revenues ("tax increment") come from the increased assessed value of property and improvements that occur within the District.

|

|

| Tax Increment Financing (TIF) Basics | |

| File Size: | 1811 kb |

| File Type: | |

How is a TIF District established?

In general, a Tax Increment Financing (TIF) District is established as follows:

- A municipality identifies an economically stagnant or physically declining area and determines that private investment in the area is not likely to occur at a reasonable rate if no public investment is forthcoming.

- A study is undertaken to determine the extent to which the proposed redevelopment project area as a whole will statutorily qualify for tax increment financing.

- Having completed the necessary research, a discussion with overlapping taxing districts and all required public meetings have been completed, the municipality prepares a final TIF Redevelopment Plan that includes its findings and approves three sequential ordinances to establish the TIF District: 1) Ordinance to Approve the TIF Redevelopment Plan and Projects; 2) Ordinance to Designate the Redevelopment Project Area; and 3) Ordinance Adopting TIF for the Redevelopment Plan, Projects and Area.

- The County Clerk certifies the total equalized assessed valuation of property in the District as of the date the TIF District is established by ordinance. All property taxes resulting from this certified initial valuation, or “base value,” continue to be paid to existing taxing bodies within the TIF District. Any new real estate tax "increment" that is generated from increases in property values after this point are re-allocated and set aside for “public and private redevelopment project costs” within the TIF District.

- The municipality makes public improvements and provides other assistance intended to spur private development in the District. To defray the cost, the municipality can reimburse TIF eligible project costs on a pay-as-you-go basis, or may in some cases issue bonds secured by the incremental taxes the improvements will generate.

- After 23 years and all TIF obligations are paid off, the TIF District ends. All future real estate taxes then generated on the new assessed valuation are distributed to the overlapping taxing bodies.

- It should be emphasized that TIF does not generate tax revenues by increasing real estate tax rates. Rather, TIF generates revenues by allowing the municipality to capture, temporarily, the new tax revenues generated by the increase in assessed valuation of properties resulting from the various redevelopment projects occurring within the TIF redevelopment project area.

Other Frequently Asked Questions About TIF:

How long does it take to establish a tif district?

The preliminary planning and statutory process to establish a TIF District will typically require 4-6 months. If annexations are required, the timeline is usually a couple of months longer.

Who controls the use of TIF Funds?

Municipal officials control the allocation and disbursement of funds from a Special Tax Allocation (TIF) Fund. TIF is the only economic development tool with which local leaders may have some control over the type of development occurring in the community. No two private redevelopment agreements are necessarily alike.

Can a tif district successfully co-exist with a school district?

Yes. TIF Districts can actually generate new money for Schools. In Illinois, school districts continue to receive all the tax revenue they were entitled to before the creation of a TIF District. Although schools usually lose State funding when assessed valuations increase, the incremental growth in property values within a TIF District is by law excluded from the property tax base when the State of Illinois calculates the amount of aid it awards to a school district. Therefore, the “poorer” a school district is, the more it stands to gain from having a TIF District. For more information about ways your TIF District can cooperate with other taxing bodies, click here.

what conditions qualify an area to be designated as a tif district?

In addition to being located within the municipal boundaries or annexed to the municipality, the TIF Act includes three sets of conditions for qualifying an area as a TIF District: (i) Blighted Conditions – examples include dilapidation, obsolescence, deterioration, inadequate utilities, declining assessed valuations; (ii) Conservation Conditions whereby at least 50% of the structures in the proposed redevelopment area are 35 years of age or older; and (iii) Industrial Park Conservation Areas, which are based largely on a relatively high unemployment rate. Within these categories, there are numerous characteristics evaluated for both vacant and improved properties. Although not very individual property must qualify, the municipality must find that at least 51% of the properties within a proposed TIF Redevelopment Project Area exhibit sufficient qualifying factors and such characteristics are evident throughout the proposed area as a whole.

How may tif funds be used?

The use of TIF Funds must comply with both the TIF Act and the anticipated uses described within the TIF District Redevelopment Plan. Generally, there are two broad categories of TIF eligible costs: Public Redevelopment Projects; and Private Redevelopment Projects. Most any expense incurred for the acquisition and preparation of sites, including public infrastructure, are TIF eligible. The vertical construction costs associated with the construction of new private buildings are not TIF eligible. Virtually all costs relating to the rehabilitation, renovation and repair of an existing structure is TIF eligible for public or private buildings located within the TIF Redevelopment Project Area. For a brief categorical list of TIF eligible project costs, click here. Contact Jacob & Klein and The Economic Development Group for details.

are properties within a tif district taxed differently?

TIF Area properties are assessed and taxed the same as in non-TIF areas. The only change is that during the life of the TIF District, the property tax revenue is distributed differently. Incremental increases in real estate taxes go to the municipality to help finance TIF eligible project costs within the TIF Redevelopment Project Area.

why offer tif incentives to private developers?

Property tax revenue generated from private development within a TIF District is new money. Without TIF, the development would not have occurred and the tax increment would not have been produced. Not only would new tax money not be generated, but the area itself would have remained economically stagnant. One of the fundamental requirements when establishing a TIF District is that the municipality must make a finding in the TIF Redevelopment Plan that the anticipated redevelopment projects would not occur, "but for" the availability of TIF. After a TIF District is established, private developers should understand that TIF IS NOT AN ENTITLEMENT PROGRAM and decisions relating to specific TIF incentives, if any, are determined by city councils and village boards on a project-by-project basis.

why does a tif district have a life of 23 years?

The Illinois TIF Act permits a TIF District to exist for a maximum of 23 years. If a project is undertaken in year 1 and assessed for real estate tax in year two, it will begin generating new real estate tax increment in year 3. The TIF District then has a full 20 years to amortize and reimburse the TIF eligible project costs, either on an annual "pay-as-you-go" basis or through the issuance of a debt obligation for which the TIF revenue will repay. A TIF District may be terminated earlier if all financial obligations are paid-off and the municipality decides to end the District, however there are often several additional public improvements within the TIF Redevelopment Project Area that can then be accelerated when the TIF eligible costs relating to the private redevelopment projects have been reimbursed and there are a few years remaining in the TIF District.

Can the life of a TIF District be extended?

Yes. With the support of the overlapping taxing bodies, an Extension of time, typically for up to an additional 12 years, is possible if then approved by the Illinois Legislature.

what happens when a tif district ends?

The full tax base, including the new TIF (equalized assessed valuation) growth, becomes available to all of the overlapping taxing bodies to levy against after the TIF District ends. Until then, all major taxing bodies meet annually with the municipality to review the progress of the District and the most recent TIF Annual Report filed with the Illinois Comptroller.

Are TIF Annual reports available on-line?

Yes. TIF Annual Reports for all TIF Districts within the State of Illinois are filed annually with the Illinois Comptroller. To search the most recent three (3) years of TIF Annual Reports for any municipality, see the Comptroller's Data Warehouse.

Are projects funded through TIF financing covered by the prevailing wage Act?

The Illinois Department of Labor (IDOL) addresses this question on line in its Prevailing Wage FAQs. As of January 18, 2019, IDOL's position was stated as follows: "Funds received from Tax Increment Financing do not qualify as “public funds”. A private project that is funded by means of TIF financing, whether via credits, reimbursement of eligible expenses through a TIF, or direct payments from the TIF, is not covered by the Prevailing Wage Act unless it also receives funding from another source which does qualify as public funds. However, if a project is undertaken by a public body, whether it is a governmental body or an institution supported in whole or in part with public funds, it will be subject to the Act."

can a tif district be created for residential development?

Yes. The TIF Act in Illinois prescribes certain characteristics of the land that must be present for an area to qualify as a TIF District. There are no special or unique qualifying factors required for residential development to be undertaken in a TIF District. The majority of our TIF Districts are mixed-use redevelopment areas capable of inviting commercial, industrial and residential projects. As in every case, the potential impacts that a TIF District may have on other taxing bodies should be evaluated carefully,

Can undeveloped Vacant land be included in a TIF District?

Yes, undeveloped vacant land may be included in a TIF District to the extent the TIF Redevelopment Project Area as a whole will still meet or exceed the minimum qualifying characteristics required by the TIF Act.

Does a TIF District affect local zoning?

No. TIF Redevelopment Project Areas must comply with all local zoning and subdivision ordinances in effect. Creating a TIF District does not itself change zoning law, however certain redevelopment projects may request zoning changes or variances.

Do individual property owner s have to give consent to include their property in a tif district?

No. Municipalities may include any qualified parcel as long as it is within the municipal boundary or is annexed, is in furtherance of the TIF Redevelopment Plan and the land is contiguous with the rest of the proposed TIF District Area.

Can I find all of the information I need about TIF on the Internet?

No. It is best to consult with a competent attorney or consultant who is familiar with the nuances of how tax increment financing functions within the State of Illinois. Although the basic concepts are often similar, there are 48 other states in the U.S. that have their own version of TIF laws and they are all different!

Can a municipality use tif funds to buy and sell property?

Yes. Within a redevelopment project area, a municipality may acquire by purchase, donation, lease or eminent domain; own, convey, lease, mortgage or dispose of land and other property, real or personal, or rights or interests therein, and grant or acquire licenses, easements and options with respect thereto, all in the manner and at such price the municipality determines is reasonably necessary to achieve the objectives of the redevelopment plan and project. The process by which a municipality may sell municipal-owned property within a TIF District is guided by the TIF Act, which provides a different procedure than the usual Surplus Property requirements found elsewhere in the Municipal Code. A Request for Proposal (RFP) is required in each instance, but the municipality is allowed to convey property it owns within a TIF District based on whichever proposal, if any, it deems to be in the best interest of the TIF Redevelopment Plan.

DOES THE TIF ACT PROVIDE DIRECTION RELATING TO CONFLICTS OF INTEREST?

Yes. Any member of the corporate authority, a member of a commission established to manage the TIF District, or an employee or consultant of the municipality involved in the planning and preparation of the redevelopment plan, or project for a redevelopment project area or proposed redevelopment project area who owns or controls an interest, direct or indirect, in any property within the TIF District is required to disclose such interest to the municipal clerk, as well as the dates, terms and conditions of any disposition of any such interest. Any individual holding such an interest in a property within the TIF District is to refrain from any further official involvement in regard to the TIF District. No such member or employee shall acquire an interest, direct or indirect, in any property within the TIF District after obtaining knowledge of the TIF District or the first public notice of the TIF plan, project or area, whichever occurs first. We recommend our clients contact us for appropriate direction and documentation to address potential TIF District conflicts of interest.

CAN TIF BE USED FOR HISTORIC PRESERVATION PROJECTS?

Yes, the TIF Act addresses the use of TIF funds for redeveloping historic resources. Specifically, the TIF Act provides that no cost shall be a redevelopment project cost in a redevelopment project area if used to demolish, remove or substantially modify a historic resource after August 26, 2008 (the effective date of Public Act 95-934), unless no prudent and feasible alternative exists. “Historic resource” for the purpose of this provision means: (i) a place or structure that is included or eligible for inclusion on the National Register of Historic Places; or (ii) a contributing structure in a district on the National Register of Historic Places. The TIF Act's direction regarding historic resources does not apply to a place or structure for which demolition, removal, or modification is subject to review by the preservation agency or a Certified Local Government designated as such by the National Park Services of the United States Department of the Interior.

CAN TIF DISTRICTS AND ENTERPRISE ZONES CO-EXIST?

Yes. Although incentives relating to real estate tax are controlled by TIF (i.e., real estate taxes cannot both be abated and reimbursed), an Enterprise Zone may still provide valuable sales tax exemptions on building materials and applicable income tax credits. Click here for more information about Enterprise Zones; or here for interactive map of Illinois Enterprise Zones.

|

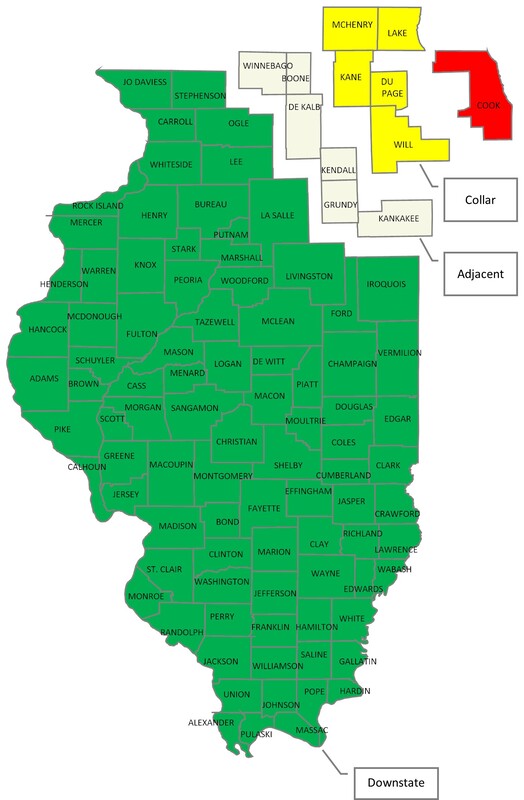

Where is TIF in Illinois?

In 2020, The Economic Development Group, Ltd. undertook another review of all TIF Districts within the State of Illinois. The results included:

To see more results of the 2020 review, click here. In 2015, The Economic Development Group, Ltd. undertook a review of all TIF Districts within the State of Illinois. The results included:

To see more results of the 2015 review, click here. Jacob & Klein, Ltd. and The Economic Development Group, Ltd. also included this information in a related presentation entitled "TIF Opportunities & Trends" at the 2018 Rural Community & Economic Development Conference in Springfield, IL. |